When you buy a stock, it's likely because you sense an opportunity. But how often do you establish the parameters for making profits? How will you know when to get in or out of a trade?

These are questions you should always ask yourself before entering a trade. Creating a step-by-step trade plan—a blueprint for how to build positions and reshape them as conditions warrant—can help you develop a disciplined approach to your trading. Without a trade plan in place, emotions could compromise your return potential or your ability to mitigate losses.

Before beginning any trade plan, perform a quick self-evaluation. Are you buying a stock for fundamental or technical reasons? Which investing style do you prefer (e.g., growth or value, trend or countertrend)? Also determine your view of market sentiment: Is momentum generally tilted up or down?

Once you have your bearings, you're ready to embark on the actual planning. Key elements of your trade plan should include your investing time horizon, entry and exit strategies, position size and trade performance review. Each step presupposes you have a list of stocks or exchange-traded funds (ETFs) identified by your research analysis method—fundamental, technical or both.

Time horizon

It's important to know how long you plan to hold a stock and what purpose it serves in your portfolio. And knowing your trade time frame depends on your trading strategy.

Generally speaking, traders fit into one of three categories:

- Single-session traders are very active and are looking to gain from small price variations over very short periods of time.

- Swing traders target trades that can be completed in a few days to a few weeks.

- Position traders seek larger gains and recognize that it often takes longer than a few weeks to achieve them.

Most traders gravitate to a particular time frame, but some employ varying time frames depending on their goals. The important thing is to make conscious decisions ahead of time.

Entry strategies

Once you have a list of stocks and ETFs you're considering, look for entry signals—for instance, divergences from trend lines and support levels—to help you place your trades. The signals you employ and the orders you use to make good on them hinge on your trading style and preferences.

Let's look at an example of a potential breakout stock, one that is moving outside a support or resistance level with increasing volume.

In the chart above, XYZ has just broken through a resistance level—the price level where selling might be strong enough to prevent further price increases. In general with breakouts, consider limiting trades to stocks that have broken through resistance areas and where trading volume is above average, not just for the trading day but for the specific time of day. In this particular example, a trader might consider buying XYZ at $123 (the "entry") and placing a stop order at $120. If the stock drops below $120, this stop order would become a market order to sell the stock. However, there's no guarantee that execution of a stop order will be at or near the stop price, so risk is not entirely eliminated.

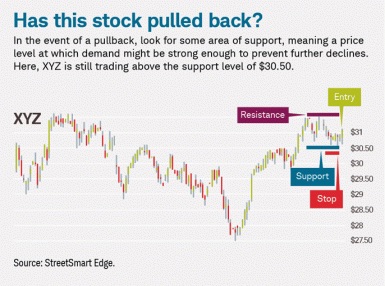

Another potential scenario is a stock that is experiencing a pullback. As you can see in the second chart, the stock has fallen from a recent peak. In the event of a pullback, look for some area of support—a price level at which demand might be strong enough to prevent further declines—such as pulling back to a moving average or an old low. Some traders even wait until the stock moves above the high of the previous day—a sign that the pullback might be over. In this example, XYZ is still trading above the support level of $30.50.

Examples are hypothetical and for illustrative purposes only.

Planning your exit

When it comes to an exit strategy, plan for two types of trades: those that go in your favor and those that go against it. You might be tempted to let favorable trades run, but don't ignore opportunities to take some profits.

Too often, investors think in terms of black and white—they either sell or retain 100 percent of their position. When a trade is going my way, I often sell part of my position at my initial target price to lock in some gains, but I might also let a portion run. I'm much more comfortable completely exiting a position when it has moved against me: I always set sell stop orders underneath a stock's support area—if it breaks below that range, I don't want to own it.

Position size

Trading is risky. A good trade plan will establish ground rules for how much you are willing to risk on any single trade. Most traders I know won't risk losing more than 2–3 percent of their account on a single trade. One way they control this "risk per trade" is by exercising portion control, or sizing positions to fit their budgets.

For example, consider a trader with $150,000 in total capital who is interested in a stock trading at $67 a share. This trader's maximum budget per trade is $15,000, or 10 percent of the account. That means the maximum number of shares of this stock the trader can buy is 223 ($15,000 ÷ $67). Let's say the trader's risk per trade is 2 percent, meaning the trader wants to lose no more than $3,000 of his or her total $150,000 on the trade. Dividing that sum by 223 shares reveals how much the stock can drop per share ($13.45), establishing a stop price for limiting losses ($53.55). The trader may never have to use this stop order, but at least it's in place if the trade moves the wrong way.

Trade performance review

It's important to know whether you are making or losing money with your trades—and just as important to understand why.

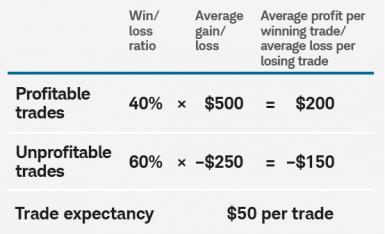

First, examine your trading history by calculating your theoretical "trade expectancy"—your average gain (or loss) per trade. To do this, figure out the percentage of your trades that have been profitable vs. unprofitable. This is known as your win/loss ratio (see first column in the table below). Next, compute your average gain for profitable trades and average loss for unprofitable trades (see second column). Then, subtract you average loss from your average gain to get your trade expectancy.

A positive trade expectancy indicates that, overall, your trading was profitable. If your trade expectancy is negative, it's probably time to review your exit criteria for trades.

How profitable are your trades?

The final step is to look at your individual trades and try to identify trends. Technical traders can review moving averages, for example, and see whether some were more profitable than others when used for setting stop orders (e.g., 20-day vs. 50-day).

Sticking to it

Even with a solid trade plan, emotions can knock you off course. This is particularly true when a trade has gone your way. Being on the winning side of a single trade is easy; it's cultivating a continuum of winning trades that matters. Creating a trade plan is the first step in helping you think about the next trade.