House Republicans on Thursday passed a monumental bill to cut taxes on businesses and individuals, the biggest step yet in the GOP's once-in-a-generation effort to overhaul the American tax system.

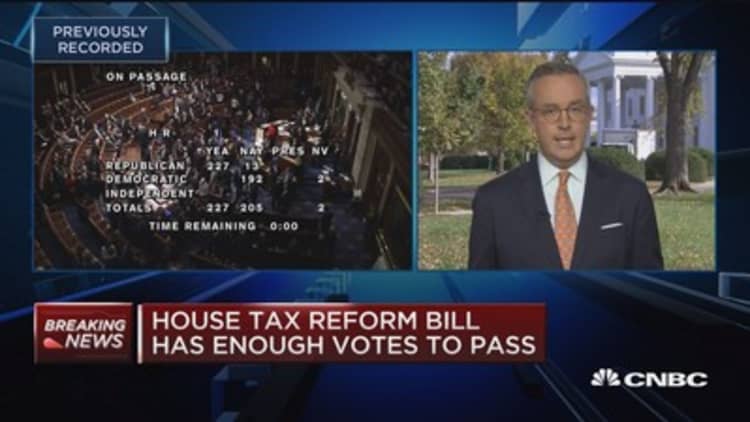

The tax reform plan passed the chamber with 227 votes in favor and 205 against.

To pass the bill, the House GOP had to overcome opposition from several of its members who live in high-tax blue states. Those lawmakers objected to the proposal's curb on popular state and local tax deductions.

The House plan would permanently chop the corporate tax rate to 20 percent from 35 percent and make other tweaks aiming to make businesses more competitive. It would reduce individual tax brackets to four from seven and make changes to several tax breaks. Among them, the bill would limit state and local deductions and the mortgage interest deduction, eliminate the personal exemption and nearly double the standard deduction.

The vote marks a significant achievement as Republicans push to put a tax bill on President Donald Trump's desk by Christmas. Trump, who along with most congressional Republicans ran on a pledge to trim taxes, went to Capitol Hill to push GOP lawmakers to support the bill before the vote.

Later Thursday, Trump called the vote "a big step toward fulfilling our promise to deliver historic tax cuts for the American people by the end of the year."

The Senate version of the bill cleared the Finance Committee late Thursday night. Despite passage of the House bill Thursday, pitfalls await the party.

Senate Republicans hope to pass their own bill as soon as the week after Thanksgiving. One GOP senator — Ron Johnson of Wisconsin — opposes the chamber's bill as written.

Several other Republicans in the Senate, where the GOP holds a slim two-seat majority, have expressed doubts about the upper chamber's version. The budget deficits generated by chopping tax rates, the expiration of individual tax cuts in 2025, and the effective repeal of Obamacare's individual mandate could all turn into sticking points in the Senate plan.

Should the Senate GOP pass its bill, the two chambers will have to craft a joint plan before Congress can pass final legislation. Agreeing on legislation carries its own challenges, like raising the money to comply with Senate budget rules without alienating Republican lawmakers.

Complicating matters for the Senate is a Joint Committee on Taxation analysis released Thursday, which says that average taxes for all income groups would go up by 2027 after initially dropping under its plan.

The most significant difference between the chambers' plans is the treatment of state and local tax deductions. The Senate plan would eliminate those deductions entirely. The measure could alienate some House Republicans who voted for the chamber's bill that would allow up to $10,000 in property tax deductions.

On Wednesday, House Speaker Paul Ryan told CNBC that keeping some type of state and local deduction would be "necessary" to make sure middle-class taxpayers in high-tax states like New York, California and New Jersey get relief.

After the bill's passage, Rep. Dan Donovan, R-NY, told CNBC that he voted no because of the elimination of the ability to deduct state and local taxes.

"This is unfair to New Yorkers. I am in favor of reforming our tax code. It's over-burdensome, it's complex, it's unfair. But the one thing that we have to do is make sure that all Americans receive a tax cut," he said.

Donaovan said he believes New Yorkers "deserve the same break that the rest of America is going to get and not pay for the tax cut that the rest of the nation is going to see."

Before the vote on Thursday, four New York Republican lawmakers who announced they would oppose the House bill said they would fight to keep the deductions when they are debated in the conference committee.

Most Americans would see taxes reduced under the plan as passed by the House Ways and Means Committee, according to the Tax Policy Center. But roughly a quarter of Americans could have their taxes hiked by 2027, the analysis said.

The Republican plan is expected to get no Democratic support throughout the process. The party, which already criticized the GOP bill as a giveaway to the wealthy, got more fuel for its opposition when the Senate added the Obamacare individual mandate repeal to its bill.

Getting rid of the provision would lead to an estimated 13 million more people without health insurance by 2027, according to the nonpartisan Congressional Budget Office. Doing so could also hike health-care premiums for many Americans by about 10 percent, the CBO projected.

Republicans say their plan will trim the tax burden on the middle class and push businesses to create jobs and boost wages. The message, so far, has not resonated with voters, according to a recent public opinion poll.

Most Americans disapprove of the Republican tax plan, according to a Quinnipiac poll. A majority also believe it will help the rich at the expense of the middle class and say it will not lead to more jobs and better economic growth.

— CNBC's Christine Wang and Michelle Fox contributed to this report.