Yuri Arcurs/PeopleImages | Getty Images

American investors are paying as much as 3.5 percent per year in advisory and fund fees.

American investors are paying as much as 3.5 percent per year in advisory and fund fees. And while the difference between a 1 percent annual fee and a 3 percent annual fee may seem trivial, it can amount to more than $400,000 over the course of a lifetime – higher than the median price of a home in the U.S.

If you include missed appreciation — since money lost to fees doesn't grow and compound — that number jumps to more than $740,000. This is money that people could have used to retire earlier or fund their kids' college tuition, but instead, it was just given away without fully understanding why.

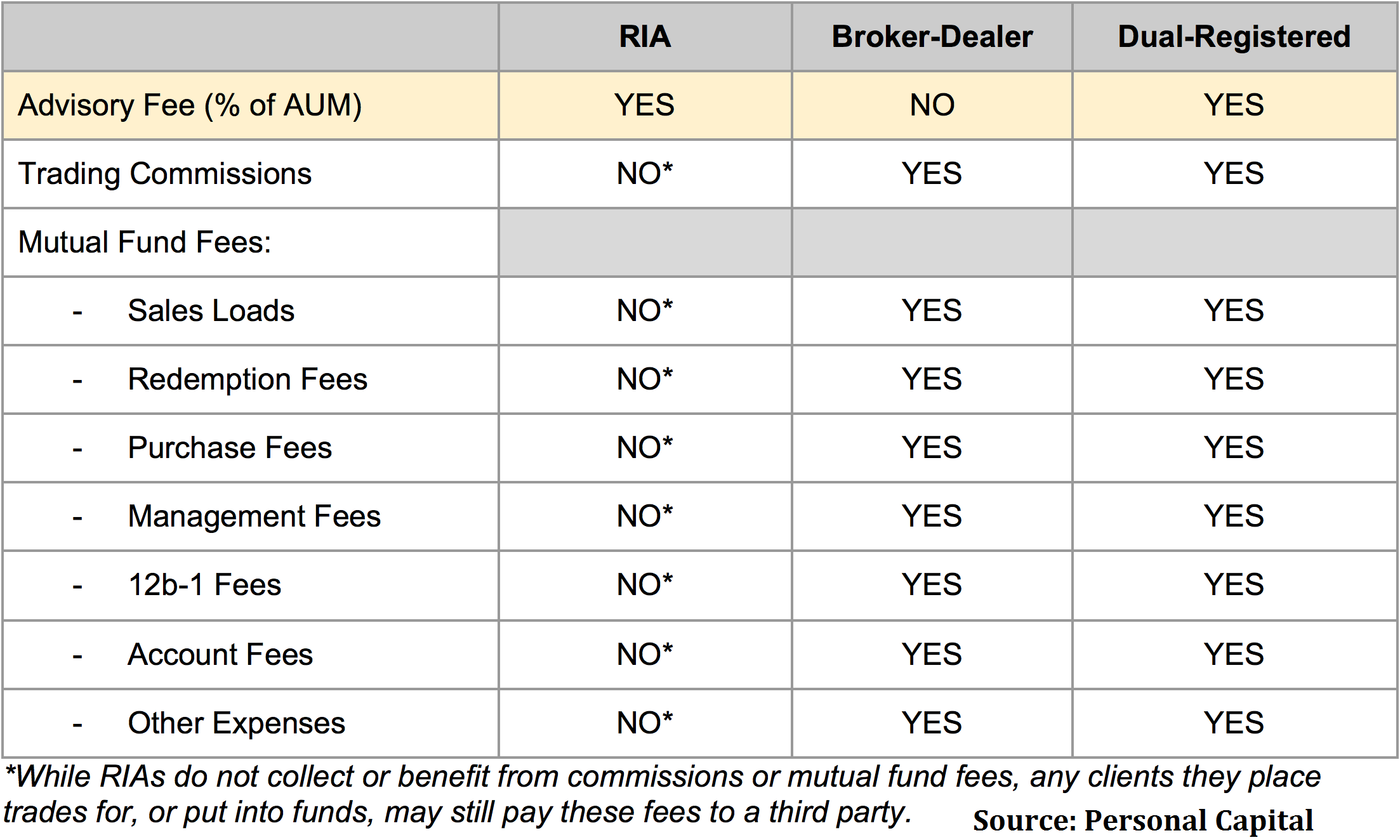

Here's the anatomy of a fee: Investment fees come in a variety of forms, based largely on the type of advisor. Most investors select from one of three provider categories: 1) registered investment advisor; 2) pure brokerage; or 3) a dual-registered broker that also acts as advisor.

More from Investor Toolkit:

Health care an ever bigger part of retirement planning

Don't get emotional about your investments

How to plan — financially — for divorce

Registered investment advisors are solely in the advice business. They typically charge a flat fee on assets under management and do not earn transaction income.

As their name suggests, pure brokerage firms historically existed to "broker" trades, not provide unbiased advice. They make most of their fees through sales commissions and other transaction charges.

Dual-registered firms operate as both an RIA and broker dealer. Under this arrangement, they charge a flat percentage of assets under management for advice, but also earn commissions or other financial incentives by selling products that they often manufacture. Dual-registered brokers freely move between their "broker" and "advisor" capacities, leaving it to the client to discern whether they're being objectively advised or being pitched a product.

Here is a summary of the types of fees typically earned by each type of advisor: