CNBC's Jim Cramer knows that a juggernaut stock market can be instrumental in sending technology stocks soaring.

"That goes double for the semiconductor space, the chipmakers that make big-picture themes like autonomous driving, internet of things, artificial intelligence, mobile, gaming [and] the data center ... possible," the "Mad Money" host said. "Strength in the semis signals that consumers are willing to spend more money on all sorts of devices, which is why this group can be such a terrific leader, especially during economic expansion like we have around the globe."

Technician Bob Lang, the founder of ExplosiveOptions.net and one of the three brains behind TheStreet.com's Trifecta Stocks newsletter, pointed out to Cramer that the semiconductor cohort has been surging higher for years.

Since the market bottomed in March 2009, the VanEck Vectors Semiconductor ETF has run 1200 percent, a monster gain relative to the almost-300 percent gain over the same period.

And the move is widespread, not just driven by powerhouse stocks like Nvidia, Cramer said. So he turned to Lang's charts to track some other strong semiconductor names.

First, Cramer looked at Intel, an old-line chipmaker that has soared to its highest levels since the dotcom bubble burst in 2000.

Since the Chaikin Money Flow Oscillator, which measures the buying and selling pressure in a given stock, turned positive three weeks ago, Intel's stock has skyrocketed.

Lang interpreted this action as institutional investors buying up shares of Intel, and Cramer liked his assessment.

"When these hedge funds and mutual funds anoint a stock as a winner and decide to buy it hand over fist, you better believe you're going to get a higher share price. At the end of the day, institutional buying is what's driving stocks higher. Intel is Exhibit A," Cramer said.

Given how much Intel's stock has run ahead of its earnings report next week, Cramer said any pullback after the company reports will give investors a buying opportunity.

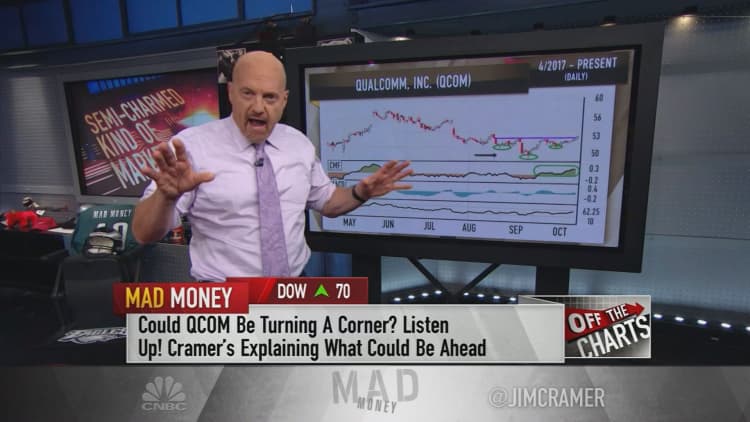

Not all of the semiconductor stocks have been out-performers. Qualcomm, which makes communications chips and mobile technology, has been lagging for most of 2017, but could be on the brink of a turnaround, Cramer said.

Lang noticed Qualcomm's stock forming an inverse head-and-shoulders pattern, which Cramer sees as one of the most reliably bullish patterns out there.

Now that Qualcomm has broken above the pattern's "neckline," surpassed its $53 ceiling of resistance and is picking up momentum according to a slew of indicators, Lang said the stock could reach $56 a share in the near future.

Some buyers are betting that, if earnings and Qualcomm's deal to buy NXP Semiconductor serve the company well, the stock could even hit $60 by the end of the year.

Finally, Cramer turned to the weekly chart of Broadcom. Through a series of acquisition, the longtime Cramer-fave has become a semiconductor giant.

Lang has watched Broadcom making a series of higher highs and higher lows. Recently, the stock formed a bullish flag pattern by trading sideways for a while after its big rally, a trend that often leads to a breakout to the upside.

Lang said that if Broadcom's shares can rally above $250, it should be smooth sailing to $300.

Final Thoughts

"The charts, as interpreted by Bob Lang, suggest that Intel's got more upside — although it would be even better after a pullback — while Qualcomm's stock might finally be getting it together, and Broadcom could be ready for another big move after a long-term breather," Cramer said. "Now, I think he's got a point. I agree with him on Intel. I'm hopeful about Broadcom. Qualcomm's got a tougher road to hoe because it's got a long-running patent dispute with Apple."

WATCH: Cramer analyzes 3 chipmakers' charts

Disclosure: Cramer's charitable trust owns shares of Nvidia, NXP Semiconductor, Broadcom and Apple.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com