Professional investors are at their most pessimistic since before the election of President Donald Trump, despite a bull market that continues to roll along.

The Investors Intelligence survey, which gauges the sentiment of investing newsletter authors, showed bullishness at 47.1 percent, a decline of 2.4 percentage points from last week. That's the lowest level since just before Trump's win back in November and comes as bearishness has risen to 20.2 percent, which is a high since the election.

As recently as July the bulls were above 60 percent, with a 2017 peak of 63.1 in late February. Bearishness had been in a range between 16.5 percent and 18.3 percent for most of the year, but has moved out of that area.

The results come amid growing concern on Wall Street.

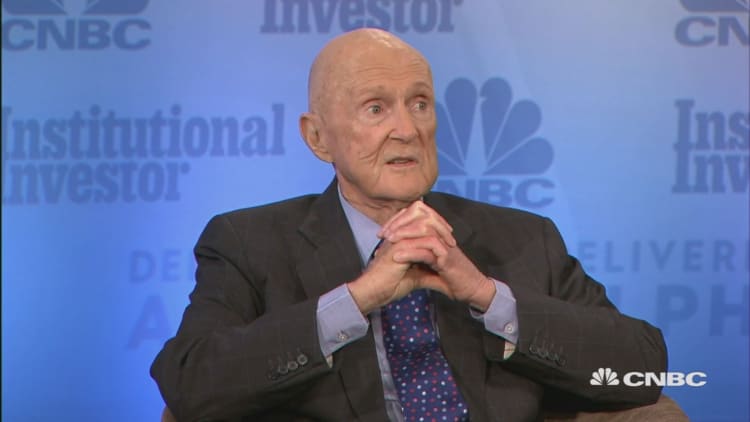

Hedge fund legend Julian Robertson called stocks a "bubble" during an appearance Tuesday at the Delivering Alpha conference presented by CNBC and Institutional Investor.

The switch in sentiment also comes as the has risen nearly 11.5 percent and has even managed to eke out a gain in September, historically the market's worst month. Stocks have pushed higher this year amid a backdrop of stronger corporate earnings, decent if still unspectacular economic fundamentals — and sentiment that Trump's policies would be market-friendly.

However, in addition to the swing in the bulls versus bears level, the share of II participants expecting a correction rose to 32.7 percent, which is approaching the 2017 high of 33.6 percent. "More than a few" respondents mentioned September's bad market reputation as the source of their fears, said John Gray, editor at II

Gray noted, though, that it's not the decline in optimism that should concern investors. Rather, it's that sentiment still remains fairly high from a historical standpoint. Surveys like the ones II conducts are often contrarian indicators, meaning that extremes in other direction indicate the investors should be doing the opposite.

"Rich stock market valuations with historical low volatility in an extended period (years) of extreme slow economic growth with fiscal uncertainty of free-market growth policies is a prescription for a severe market correction at a minimum!" Conrad Kuhn wrote in The KonLin Letter as cited in the II report.

Retail investors have become even more cautious than the pro side.

In the most recent American Association of Individual Investors survey, bulls stood at just 29.3 percent while the bears were at 35.7 percent.