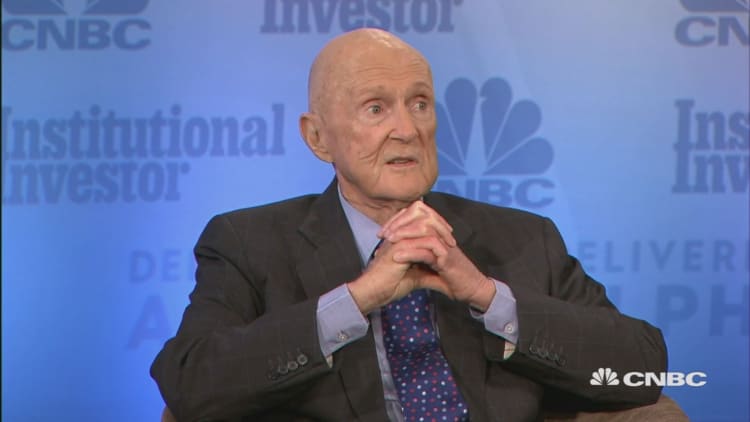

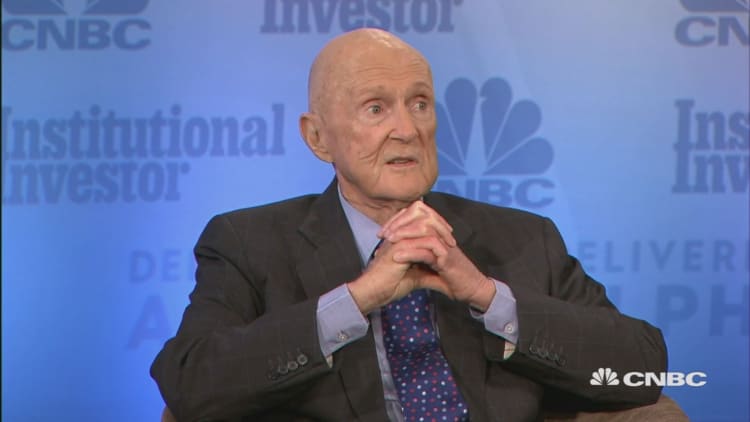

Hedge fund legend Julian Robertson Jr. sees stock market valuations as "very high" and worries about a bubble forming.

The Tiger Management founder made the comment Tuesday at the Delivering Alpha conference presented by CNBC and Institutional Investor.

Central banks including the Federal Reserve should get the blame for the high market valuations through their programs to keep rates low and make sure investors did not have other alternatives to get returns.

"The market as a whole is quite high on a historical basis," he said. "I think that's due to the fact that interest rates are slow low. But there's no real competition for the money other than art and real estate."

The Fed and others have kept rates low since the financial crisis in an effort to spur growth. The U.S. central bank is in the process of gradually raising rates, but the Fed benchmark is still low by historical standards.

"I think we need interest rates to appreciate, to go up, because I think we are creating a bubble," he added.

While Robertson said the market as a whole is expensive, he did not apply that to the leading tech stocks, including Facebook and others. He said those stocks remain cheap based on their profit potential.

He also continues to back Air Canada, a stock he said he bought when it traded around $8 or $9 a share and which trades now above $23.

Robertson also is politically active and shared his views on what's happening now. Like many of the earlier speakers, he is an advocate for tax reform and specifically the repatriation of overseas cash at lower levels.

Robertson is perhaps best known for predicting the tech bubble in the late 1990s. He also is well known for his philanthropy.

He is now still busy investing in other funds run by his former employees — "Tiger Cubs," as they are known in the hedge fund industry.

"By and large it's been a fabulously fortunate thing for me to get exposed to those people," he said. "I'm thrilled every time I see the progress they're all making."