Wall Street was teeing off on Goldman Sachs after the bank released its earnings Tuesday, with one prominent analyst calling for the ouster of CEO Lloyd Blankfein.

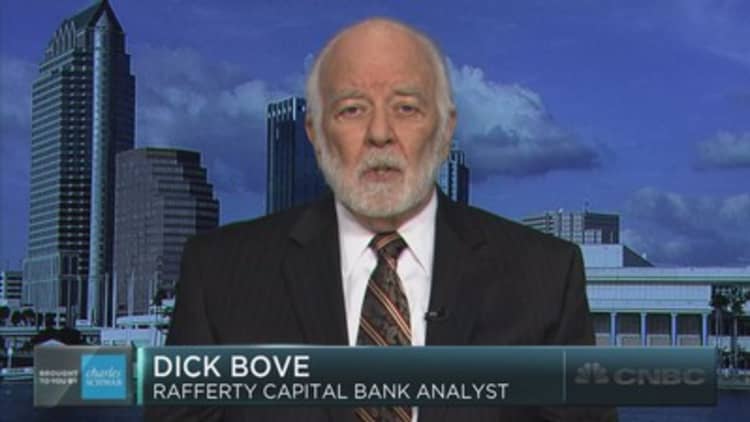

Blankfein has held the reins at Goldman since 2006, a time during which the business has stagnated and is continuing to lose ground to its peers, said Dick Bove, vice president of equity research at Rafferty Capital Markets.

"How many companies keep a CEO around for that long when there's been a classic mistake in the business model which has resulted in a loss of market share and no increase in earnings and no increase in the stock price?" Bove said in a phone interview. "There's something wrong with the structure."

Though Goldman easily topped consensus estimates on for profit and sales — $3.95 a share and $7.89 billion respectively — traders instead focused on a 17 percent decline in trading. That number included a 40 percent plunge in the vital fixed income, commodities and currencies business.

As a result, shares were off 2.4 percent in afternoon trading.

A few months ago Bove cut his rating on Goldman so "hold" from "buy." He said he is not planning any further downgrades but believes the bank needs "a shakeup."

"The stock price ... is right where it was 10 years ago," he said. "The company's desire to wait for recovery in its core business and therefore make no major changes has been a critical error. I quite frankly simply don't understand how they're getting away with it."

[Goldman's share price actually is up about 30 percent since 10 years ago to the day, to be precise, but has flatlined since peaking shortly after, in September 2007.]

This is not the first time Bove has called for Blankfein to be removed; in 2011 he demanded the CEO's head following a settlement the firm made with regulators, then switched a month later, saying the firm had been done "a terrible wrong."

"Their reputation remains extremely high. They have extremely qualified people," Bove said Tuesday. "But the level of inertia in that company is staggering relative to anyone else in the financial services industry."

Goldman Sachs declined comment.

Brian Kleinhanzl, an analyst at financial services firm Keefe, Bruyette & Woods, said questions are bound to be raised about Blankfein's stewardship.

"It's hard to see big changes occurring with Lloyd there," Kleinhanzl said. "So to the extent that's what's required to reinvigorate the revenue growth, then that certainly is cause for concern. Given you just had changeover at the top of the management, I think it's too early to see changes at that level."

Indeed, the company this year lost its president and chief operating officer, Gary Cohn, who left to take a job as President Donald Trump's top economic advisor. Also, Michael Sherwood, considered a top candidate to replace Blankfein when the latter steps down, also left, preceded by other members of the operating committee over the past two years or so.

"Are they missing deeper experience with the guys they have on now? I don't have the answer to that. I don't know that Goldman does either," Kleinhanzl said.

As analysts puzzled over what's next for Goldman, one firm changed its view.

CFRA — formerly S&P — cut Goldman from a "buy" to a "hold" and lowered its price target by $10 to $245 a share. Analyst Ken Leon said he also was cutting his full-year earnings estimates for 2017 by 70 cents to $18.30 and 2018 by $1.50 to $19.50 a share.

Leon suggested the firm needs to rethink its focus on commodities, which had its worst quarter ever — and is Goldman's bread and butter — or things could well get uncomfortable for the CEO.

"I don't know if he can, but it's really up to the leadership and board of directors. It may be 'hold the course,'" Leon said. "Obviously, I would say Lloyd Blankfein has done a great job since the financial crisis. But there might be some strategic issues here that he may not be the best one to lead if it relates to hard decisions on currencies and commodoties, which is his heritage before rising to senior ranks."

"I think if the third quarter doesn't show a surprise on the upside in trading activity, there will probably be more increased questions from the Street," he added.

Other analysts took a dim view as well.

Jeffrey Harte at Sandler O'Neill said the trading slump "is likely to fuel investor concerns about franchise deterioration." And Charles Peabody, an analyst at Compass Point, said the earnings and revenue beats don't mask the underlying weakness.

He said the beats were boosted from gains in private equity lines that "the marketplace won't pay up for."

Elsewhere, BMO Capital Markets analyst James Fotheringham lowered his price target on Goldman from $208 to $202, implying a nearly 9 percent decline from Monday's close, while Argus analyst Stephen Biggar kept his "hold" rating, citing "sluggish revenue trends" that could be reversed once the Trump administration and Congress get to work cutting regulations in the financial industry.

WATCH: Bove says let the bank merger boom begin