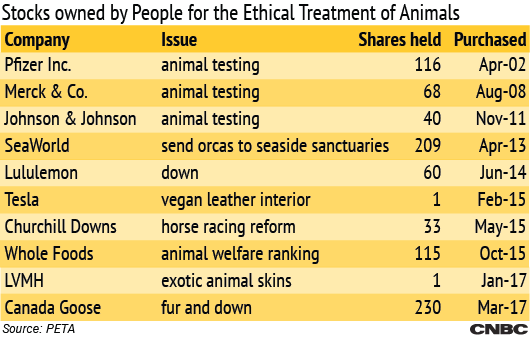

When Canada Goose went public earlier this year, there were scores of investors ready to nestle the winter coat maker into their portfolios. One surprising IPO buyer was PETA, the animal-rights activist organization often thought of publishing graphic pictures of animals in distress and throwing paint on fur-clad pedestrians.

The public may not think of People for the Ethical Treatment of Animals as the Wall Street types, but the group has a sizable portfolio that includes dozens of companies.

They're not in it for the money: By purchasing shares, PETA earns the ability to appear at annual shareholder meetings and introduce shareholder resolutions to further their cause. Each stock is bought with a particular issue the groups wants to focus on, from a pharmaceutical company that tests its products on animals to lonely whales in an aquarium.