Blame it on the bunny.

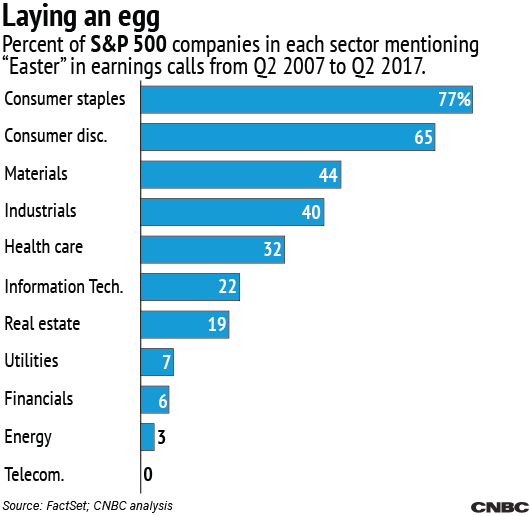

Every year, dozens of companies reference the Easter holiday in their earnings conference calls. From lingerie to soft drinks to airline tickets, companies across the S&P 500 expect to get a basketful of extra revenue from the holiday in late March or early April, but it doesn't always work out.

Any company expecting a boost in the first quarter like we saw last year is counting its Easter eggs before they hatch. That's because the holiday doesn't fall in the same quarter every year — instead, it's on the first Sunday after the first full moon occurring on or after the vernal equinox. That means it could be any day between March 22 and April 25. This year, it's April 16.

Last year was special, with the holiday falling in March, as it also did in 2013 and 2008. With Easter shifting back to April this year, first-quarter results are going to look weak when compared to last year. Executives will be sure to throw the Easter bunny under the bus.