Investors have been disappointed by the weak stock performance in the first few days after the Snap IPO. It appears that the social media company may not be the new Facebook after all.

But wait — Snap's poor showing makes it more like Facebook than not. After all, Facebook, today's high-flying tech stock, also plummeted in its first week on the market in May 2012. Shares didn't recover to the first-day opening price until over a year later in September 2013.

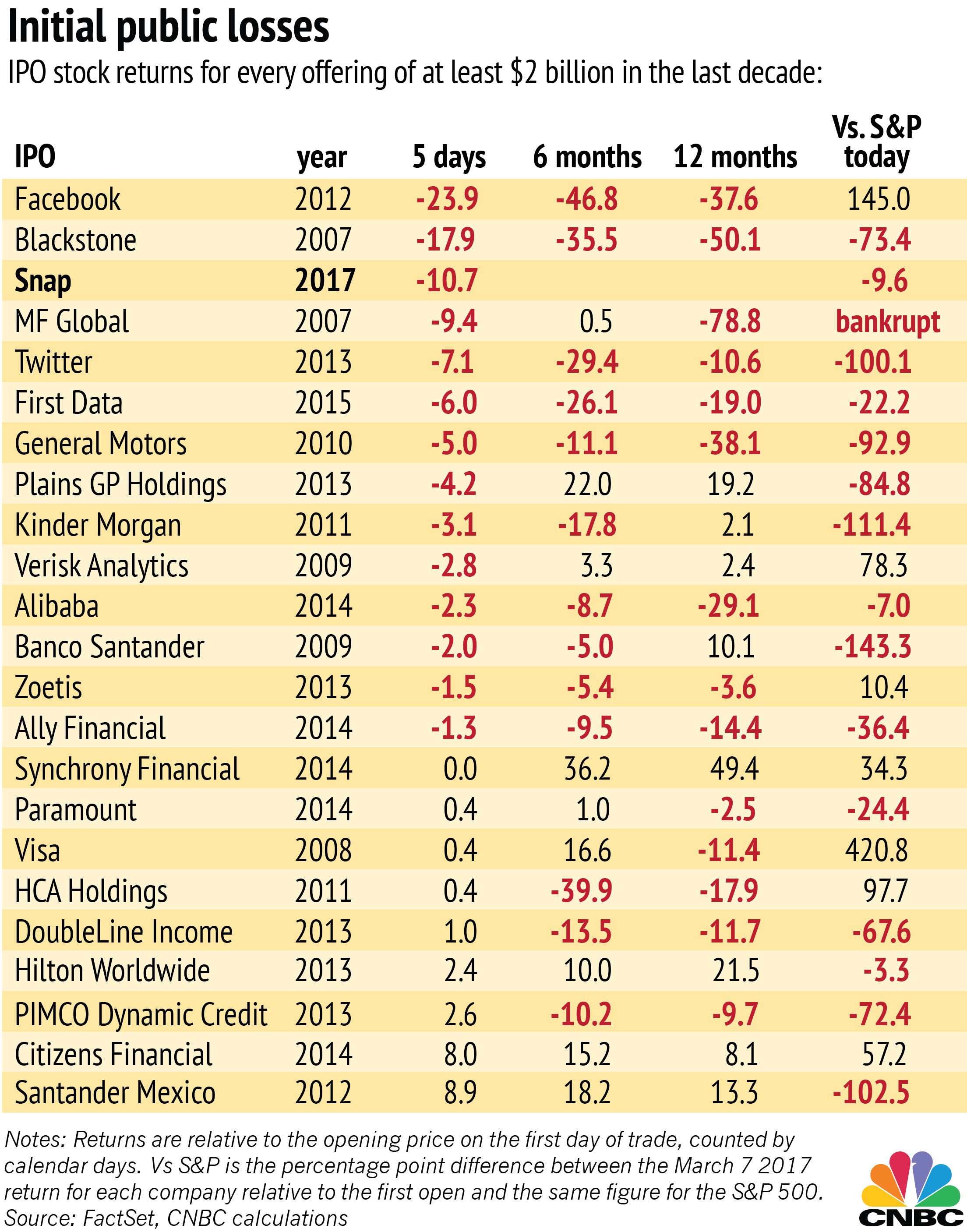

In fact, about 40 percent of all IPOs in the past decade were down five days after their first trading day, according to a CNBC analysis of FactSet data. Bigger IPOs bringing in at least $2 billion did poorly even more frequently — down about 65 percent of the time in the same time frame.