Nobody hugged it out on stage, but Jim Chanos did get a travel invitation. The word of the day was "danger." And Donald Trump got a few shoutouts, not all of them kind.

In sum, it was another action-packed and unpredictable day at the Delivering Alpha conference, presented for the sixth time Tuesday by CNBC and Institutional Investor.

Epic moments abounded. But we broke it down to five that, if you weren't there, well, you missed it:

Anyone for Trump? Anyone? Bueller? Icahn?

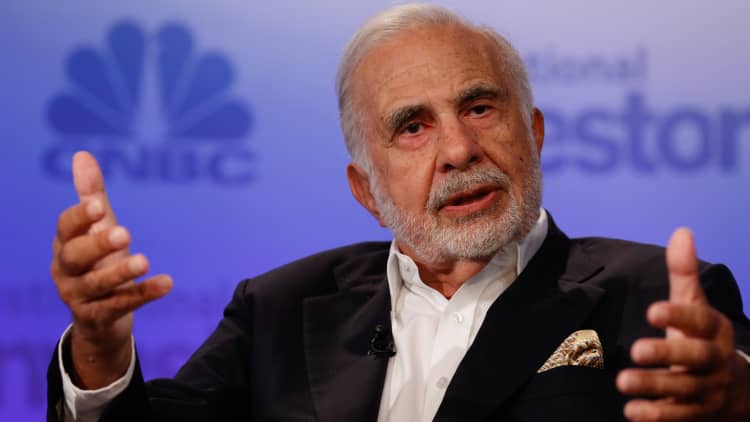

Investors during one panel discussion were asked if they had met Republican presidential nominee Donald Trump, and several raised their hands. When Avenue Capital's Marc Lasry then asked the room how many would do business with Trump, no one raised a hand. Not. One. Person. At least among panel members, there seemed to be not a lot of support for either candidate, though the Trump moment stood out. (The audience was asked the same question regarding Hillary Clinton, and a smattering raised their hands.) Later in the day, Trump got a little boost when Carl Icahn urged support for the New York real estate tycoon, whom he said would be better for the economy.

Delivering 'danger'

The conference ostensibly is supposed to generate ideas to beat the market. But for many in attendance, the prospects are gloomy. Paul Singer of Elliott Management warned that this is "a very dangerous time" for investors. Bridgewater Associates' Ray Dalio said the bond market is "in a dangerous situation." Icahn said it is "very dangerous" in the market. And there were others, all warning that these are perilous times indeed.

Hey Jim, come out and see me sometime

Short-seller Chanos has repeatedly criticized Alibaba, and on Tuesday he bashed the Chinese e-commerce giant's logistics arm and its accounting. Alibaba executive vice chairman Joseph Tsai responded later in the day, saying Chanos has withstood "pain" shorting his company's stock and invited him to Alibaba's headquarter to better understand the business. Pain? That's one word for it. Chanos, in fact, has gotten absolutely clobbered on this bet. Since he announced his short at a Nov. 6 conference, shares are up about 22 percent.

Somewhere, Bill Ackman was smiling (however briefly)

Of the smattering of stock picks that took place, Bill Miller's call on Valeant was easily the boldest. Miller, chief investment officer at LMM, said he thinks the embattled drugmaker is "a completely different company" than the one that was under severe fire for jacking up drug prices, and could see returns of 25 percent to 30 percent per year over the next five years. That would be quite a turnaround, considering shares are off 73 percent this year and nearly 88 percent over the past 12 months. It also would be music to Bill Ackman's ears. Ackman's Pershing Square Capital has a 6.2 percent stake in the company — a $3.3 billion bet that was worth as of Wednesday afternoon $618 million. (Shares were up 0.7 percent in afternoon trading.)

But ... Uncle Carl gives Ackman an elbow

Ackman wasn't at this year's conference, but his presence was felt in multiple years. Remember when he and Icahn hugged out their differences at the 2014 gathering? Yeah, well, forget about it. Icahn denied the two were feuding again per se (despite some incendiary comments he made to CNBC.com a few weeks ago). But as the day's final speaker, he couldn't leave the stage without blowing one more kiss at Ackman: Icahn disclosed that he has now asked his company for permission to take up to a 50 percent stake in Herbalife, the supplement company over which the two have battled so publicly.

And, of course, nothing Icahn does in investing circles goes unnoticed. Herbalife shares gained a couple percent in after-hours trading Tuesday and rose 3.5 percent Wednesday. How's that for Alpha?