Giants of investing, business and policy will talk about the state of markets and the U.S. economy at the Delivering Alpha conference Tuesday in New York City.

Top investing minds will discuss where they see opportunities in a U.S. stock market that is floating near all-time highs. They'll also give their thoughts on navigating the risks posed by a key Federal Reserve meeting next week and the looming presidential election.

Here are some of the key speakers at this year's event, which is presented by CNBC and Institutional Investor.

- Jack Lew: Lew has served as U.S. treasury secretary since 2013. Recently, the Obama administration and Treasury have tried to curb tax inversions, where a U.S. company acquires a firm overseas and changes its tax address to pay lower rates abroad. One rule change led to Pfizer and Allergan dropping a $160 billion merger. Lew has also spoken out about a recent European Commission order for Apple to pay back taxes to Ireland, calling it "inconsistent" with established tax law.

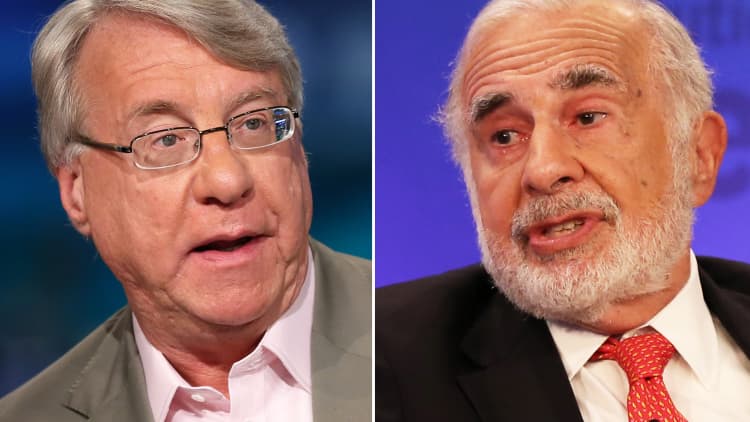

- Carl Icahn: Since he spoke at Delivering Alpha last year, the billionaire activist investor has dumped his stake in Apple over China concerns and boosted his stake in Herbalife, reigniting drama with fellow billionaire Bill Ackman. The Icahn Enterprises chairman is also an outspoken supporter of Republican presidential nominee Donald Trump, though he does not hold a formal economic advisory role in the campaign.

- Tim Geithner: Geithner led the Treasury Department before Lew, from 2009 to 2013. He served under President Barack Obama during the fallout and recovery from the 2008 financial crisis. Last year, Geithner told CNBC that another financial crisis would likely happen at some point, but structural reforms since 2008 would mitigate the damage.

- Ray Dalio: Dalio is the founder of Bridgewater Associates, the largest hedge fund in the world. In February, when markets reeled in the wake of a Fed interest rate hike and amid global economic weakness, Dalio told investors to expect "lower than normal returns with greater than normal risk." Still, the has risen about 4.5 percent this year, even after a brutal start. Bridgewater's flagship fund reportedly lost 12 percent in the first half of the year.

- Paul Singer: Singer heads the $27 billion Elliott Management hedge fund. In an investor letter this summer, Elliott called the bond market "broken." Singer, a major Republican donor, has so far shied away from giving to Trump's campaign and said this summer that the candidate's policies would cause a depression.

- Stephen Schwarzman: Schwarzman is the chairman and chief executive officer of the Blackstone Group, which oversaw more than $350 billion in assets as of June 30.

- Jim Chanos: Chanos, the short-seller and Kynikos Associates founder, has been outspoken this year about his bets against Tesla Motors and SolarCity. In June, he bashed Tesla's proposed acquisition of SolarCity, calling it a "brazen" bailout.

- Bill Miller: The value investor has touted several beaten-down stocks this year. Earlier in 2016, the LMM chairman said Valeant Pharmaceuticals and Twitter could climb.

- Joseph Tsai: Joseph Tsai is executive vice chairman at Alibaba, the Chinese e-commerce giant. Its U.S.-traded shares have climbed more than 50 percent in the last year.